ENWEX For Power Trading Risk Management

The ENWEX index is a transparent, readily available wind and solar index designed to enable power market weather risk analysis and management. While the ENWEX index defines weather indices for European, US, and Australian power markets, the most widely used is the German wind index. This index is so popular that the Abaxx Exchange recently announced trading for the German ENWEX wind index. Trading the ENWEX index is transitioning from primarily “over-the-counter” trading to a more transparent and standardized trading platform.

The rise of ENWEX trading necessitates additional market information, enabling traders to develop their “edge” to generate profitable trading. In power and gas markets, weather forecast information is a crucial source of information due to the weather’s significant impact on energy demand and supply. The ENWEX index trades because it’s designed to directly reflect the impact of wind speeds across Germany and their impact on German wind power generation. As with the broadly traded power and gas markets, ENWEX forecasts are likely to be a critical source of trading information.

What is ENWEX?

The ENWEX Index is a standardized family of Energy Weather indices that convert meteorological conditions into country-level, tradable metrics for wind, solar, and temperature, enabling objective measurement and hedging of weather-driven volume risk in power markets. It is published with hourly granularity and day-ahead settlement, designed to fit established market conventions and support contracts spanning from single hours to calendar years. Methodology and governance are documented in an official rulebook that emphasizes transparent construction designed for traders and market users. ENWEX indices can also be combined with power prices to derive market values, and they already serve as benchmarks for listed financial products, such as the euro-denominated Enwex German Wind futures at Abaxx Exchange.

ENWEX Forecast History: An Introduction

The World Climate Service has developed an archive of ECMWF, available AIFS, GEFS, and GFS weather forecasts. The data is available from the Point-in-Time (PiT) Weather Forecast Archive API.

The ENWEX index is calculated using the first 24 hours of the ECMWF HIRES forecast model using a small set of points across Germany designed to represent a wind power capacity weighting to the geospatial 100m wind speed data.

A 10-Year ENWEX Forecast History

We’ve used a 10-year history of ECMWF IFS forecasts to generate a history of German wind ENWEX forecasts. The history spans from 2015 to the present day and is updated in real-time. It also includes the full 51-member ensemble forecast history, enabling improved risk analysis of potential ENWEX outcomes.

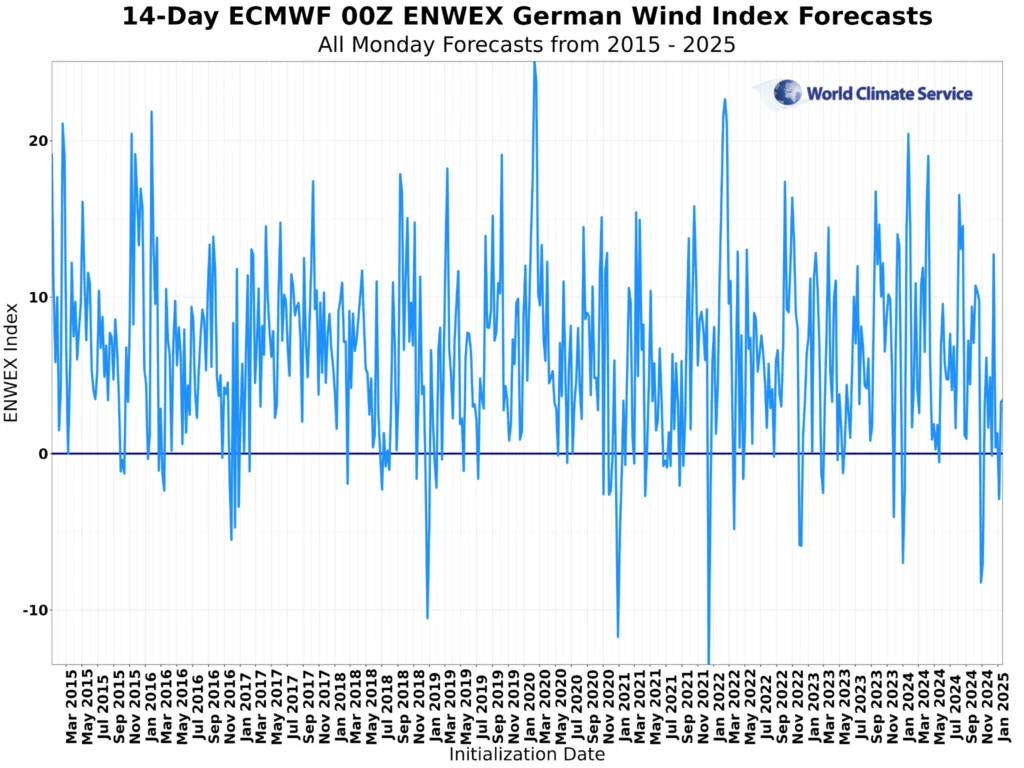

Figure 1 shows the 14-day ECMWF 00Z ENWEX German Wind Index forecasts for all Mondays from 2015-2025. The majority of the forecasts are positive with a minimal amount of forecasts below zero. To access the ENWEX forecast history, click this link!

Figure 1. 14-day ECMWF 00Z ENWEX German Wind Index forecasts for all Mondays from 2015-2025.

The World Climate Service and CropProphet have made it easier for commodity traders to win weather-based commodity trades. We’ve released a weather forecast archive containing an eight-year history of weather forecasts.

The product is called the Point-in-Time (PiT) Weather Forecast Archive API.

The data provided by the API enables systematic and discretionary commodity traders to:

- Trade forecast surprises by quantifying physical, futures, and options market responses to weather forecasts and their changes.

- Trade the forecast errors by evaluating recent and historical weather forecast performance.

- Trade forecast momentum by understand the chances of continued model changes in the same direction multiple times in a row.

ENWEX Forecast Archive

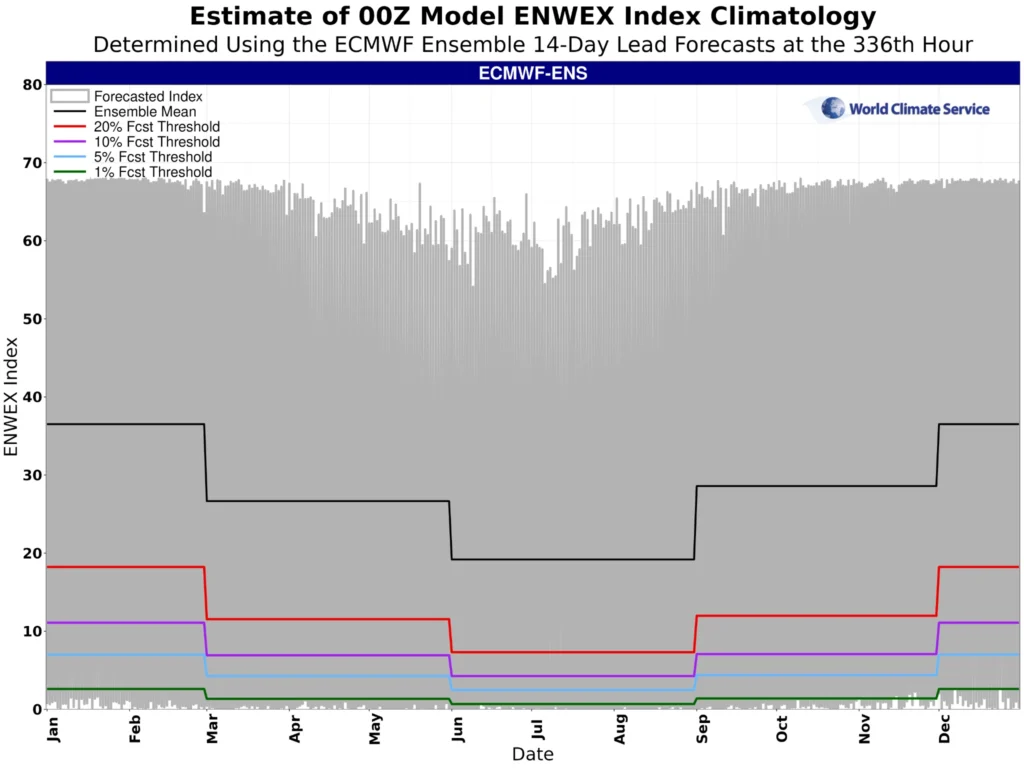

Figure 2 shows the estimate of 00Z modelENWEX Index climatology which was determined using the ECMWF ensemble 14-day lead forecasts at the 336th hour. Get access to the ENWEX forecasts here.

Figure 2. Estimate of 00Z modelENWEX Index climatology using the ECMWF 14-day lead forecasts at the 336th hour.

ECMWF IFS ENWEX Forecast Performance

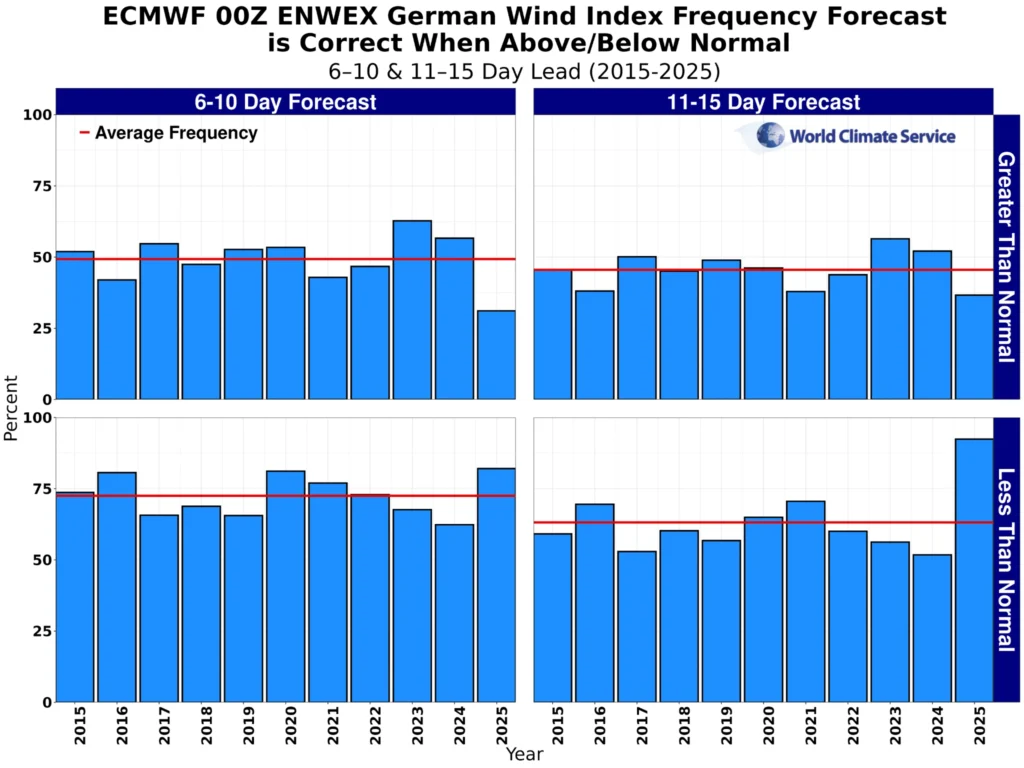

How has the ECMWF IFS ENWEX forecast been performing? Figure 3 shows the ECMWF 00Z ENWEX German Wind Index frequency forecast is correct when above/below normal for 6-10 & 11-15 day lead times from 2015-2025. This graphic shows that less than normal forecasts verify better.

Figure 3. ECMWF 00Z ENWEX German Wind Index frequency forecast is correct when above/below normal for 6-10 and 11-15 day leads from 2015-2025.

Historical Weather Forecasts for Power Trading

The PiT Weather Forecast API provides power traders with eight years of weather forecast history for:

- US Independent System Operators. For example, review our analysis of ERCOT renewable power curtailment forecasts.

- US States with significant renewable power production

- European Transmission System Operators, including Nordic subregions and German TSO regions. For example, read our German wind power capacity factor forecasting analysis.

The power index values calculated include:

- Population-weighted daily maximum and minimum temperatures,

- Wind power capacity weighted 100m wind speeds,

- Solar power capacity is weighted by solar radiation.